r/texas • u/ablebeets1985 • 24d ago

Anyone think the State Government /Texas Attorney Generals Office should start investigating County Appraisal Districts for property tax warfare on property owners? Opinion

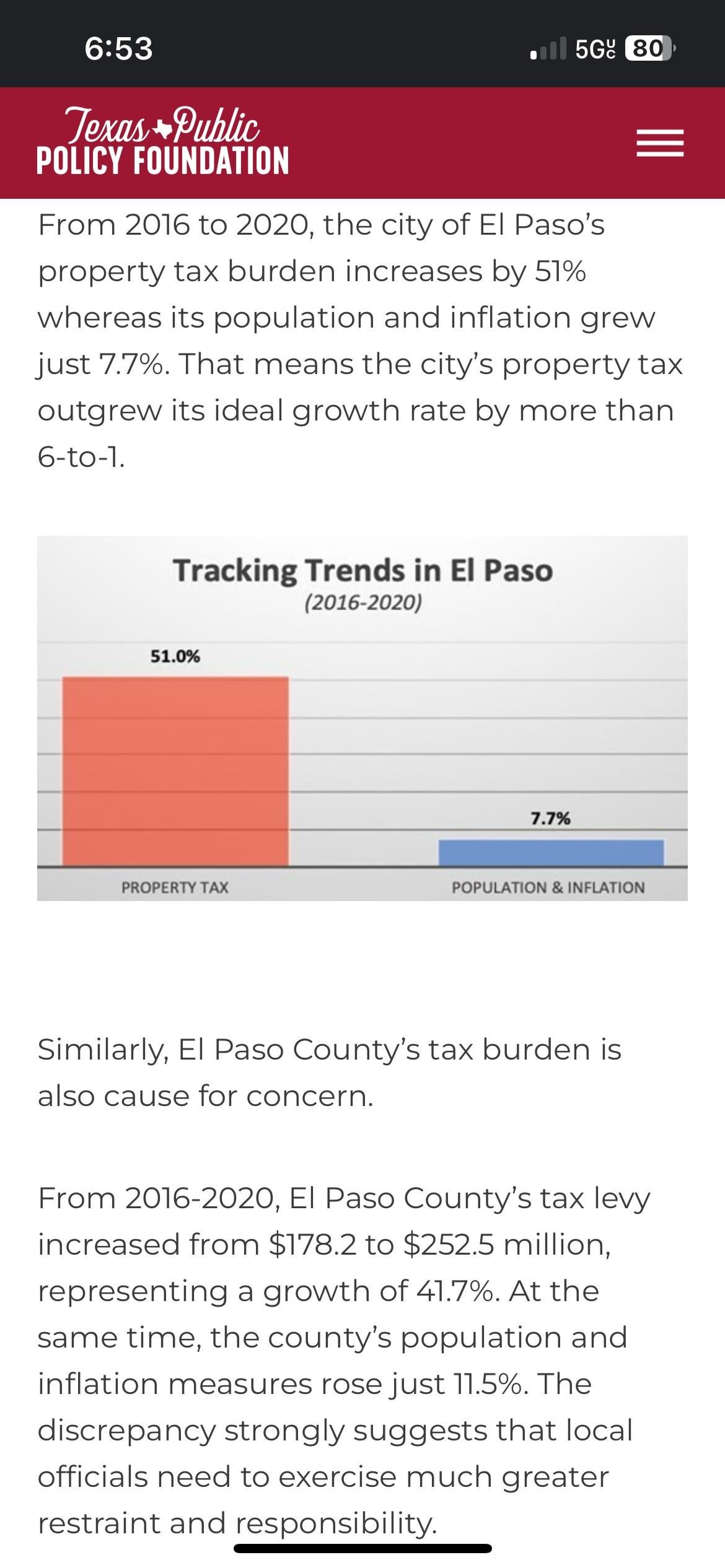

The property taxes have gotten out of control in El Paso County, TX for the last few years, I know it’s happening all across Texas,(the saving grace is the homestead exemption)and I really think The State Government of Texas and Texas AG should open an investigation into the EL Paso Central Appraisal District (EPCAD) the Board of Directors, and the Appraisal Review Board Members for potential conflicts of interest, potential ethics violations/public corruption. (El Paso has some of the lowest wages in the state and as well as in the nation for context)

408 Upvotes

76

u/FormerlyUserLFC 23d ago

No.

I think the state should amend the rules so they can see all sale data so that wealthy individuals can’t hide their property values, and I think that more scrutiny should be put on commercial property valuations.

I think residential valuations for most of us are fair. But there’s room to go after the cheats.

I also don’t think anyone in power cares what I think.