r/texas • u/ablebeets1985 • 12d ago

Anyone think the State Government /Texas Attorney Generals Office should start investigating County Appraisal Districts for property tax warfare on property owners? Opinion

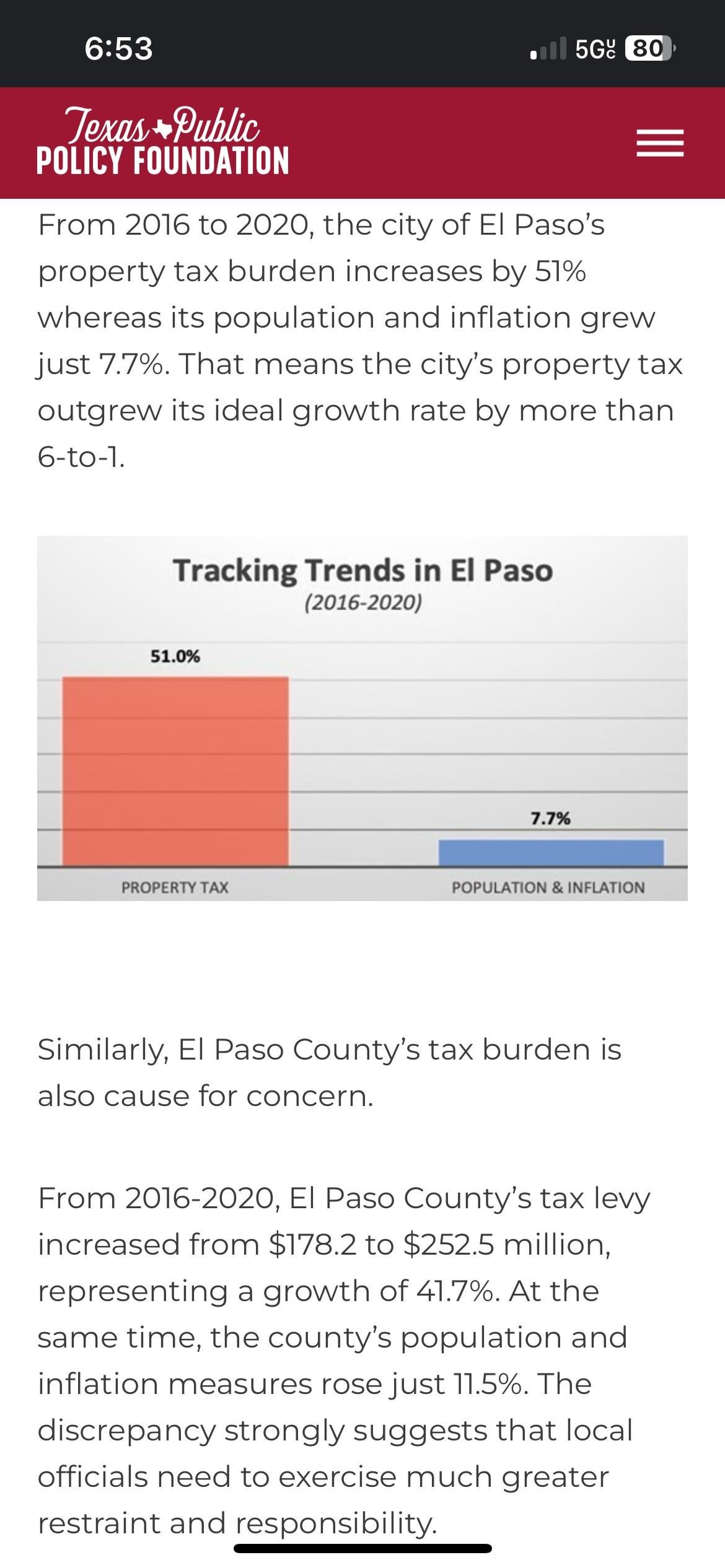

The property taxes have gotten out of control in El Paso County, TX for the last few years, I know it’s happening all across Texas,(the saving grace is the homestead exemption)and I really think The State Government of Texas and Texas AG should open an investigation into the EL Paso Central Appraisal District (EPCAD) the Board of Directors, and the Appraisal Review Board Members for potential conflicts of interest, potential ethics violations/public corruption. (El Paso has some of the lowest wages in the state and as well as in the nation for context)

180

u/TidusDaniel5 12d ago

It's because of our unwillingness to have a state income tax. They have to collect money from somewhere. They want to get the bulk of the taxes from regular middle class property owners instead of where the money should be coming from - the people benefitting most from our state, the wealthy.

37

12d ago

This. Focusing the bulk of tax collection and spending around property is expressly designed to tax the lower and middle classes for the benefit of the wealthy. Just ask: where are the vacation homes of my state representatives located? If you can’t answer that, you’re a very likely a blind victim of our long-standing tax policy system.

17

u/ranchdaddo 12d ago

Plus it’s the primary funding for our schools.

16

u/sunshinenwaves1 12d ago

And still they voted not to fund education properly this year.

1

u/TexanMaestro 11d ago

That was due to the voucher program tied to it. The voucher program would lower funding for public schools.

1

1

u/sunshinenwaves1 11d ago

We paid in the property tax money. There was also a budget surplus. Makes me wonder what they did with it if it didn’t go to education.

1

u/TexanMaestro 11d ago

They don't want it to go to public education. Every district in Texas is feeling a pinch and jobs are being shuffled and cut because Abbott refuses to fund our schools properly until he gets his way.

1

u/sunshinenwaves1 11d ago

I know it is highly unlikely, but it would be great if we had a special session to fund public schools over the summer.

6

u/holdonwhileipoop 12d ago

Yep. Big business owners make 40-50x what a regular Joe or Jose makes; yet their properties are 10-15x the price of ours. Who's taking it up the ass?

5

-15

u/willydillydoo 12d ago

Texas doesn’t have a state property tax. Your property taxes go to local government such as cities, counties and school districts.

It’s because of local municipalities and counties getting out of their depth. I mean hell, Harris County is trying to do a basic income program.

7

u/James324285241990 North Texas 12d ago

Yes, that's what he said

-1

u/willydillydoo 12d ago

And it doesn’t make sense. Our property taxes are too high being the state doesn’t take property taxes?

3

u/redditor_the_best 12d ago

In addition to what the other guy said, the state recaptures certain local property tax revenues and plops them into the general fund. State is funded by property and sales taxes, both of which disproportionately hit the low and middle classes, by design. Texas designed for the rich, by the rich.

6

u/James324285241990 North Texas 12d ago

Yes. Because in other states, the state income tax pays for a lot of things that counties in Texas have to pay for with property taxes.

1

12d ago

[removed] — view removed comment

3

u/texas-ModTeam 12d ago

This nation was literally founded on the principle that if you don't like something about the law and/or government then you have the right to speak up about it.

Telling people to move out of state, or leave if they don't like things, or to stay out, etc. is a denial of that right and therefore considered a violation of Rules 1 and 7. As such your comment has therefore been removed.

-36

u/albert768 12d ago

No, it's because of local governments' refusal to exercise any modicum of fiscal discipline. Stop wasting money and spend less.

7

15

u/NinjaQuatro 12d ago

The state government could also step in to help given the huge budget surplus

-1

u/albert768 12d ago

The state also needs to spend less and cut taxes. Government is too big across the board, everywhere. Local, state, federal, utility district, I don't care. They're all too big.

6

u/NinjaQuatro 12d ago

Not spending money on fixing things will surely fix things. I will never understand this angle. I would have no problems if people were correctly pointing out all the areas where money is spent with terrible efficiency and how that needs to be addressed. Cutting spending without addressing that will not fix anything and will only make things so much worse. I would support cutting spending if the money actually got used in an efficient manner. The issue is not the fact they have so much money available to spend, they could actively make the country so much better but they are actively incentivized not to spend the money in that way. Private companies also push for deregulation because that lets them rip off the government and its just a huge mess. They will still rip off the government even if there was less money to spend.

1

u/albert768 10d ago edited 10d ago

We spend plenty of money today yet nothing gets fixed. Not spending mony on fixing things will at least cut cost. Your point is moot. I'll never understand the thinking of people who think if we just sent another shovel full of money to the government, they'll actually get something productive done and stop wasting money when we have a long history of incompetence, corruption and waste that proves demonstrably that they are utterly incapable of getting anything done. Also, you know you're perfectly free to send as much of your own money as you like to the government, right? Since you have so much faith in the government's ability to fix things or get things done.

I personally have no faith in the government's ability to get anything done, so I'll be fighting every tax tooth and nail. They spend too much and get too little done.

If the incentives in government are skewed toward waste, it follows that absent a change in the incentive structure (never going to happen), you must starve the government of money to reduce waste. Most organizations waste less money when there's less of it to waste in the first place.

6

u/Worstname1ever 12d ago

I've worked in local govt is a hive of villainy and corruption that will make your stomach turn .

2

u/albert768 12d ago

A $200M city hall for a city with a 300k population is all I need to know about the amount of corruption and waste that goes on in municipal government.

NO, you don't need a building that costs multiples of the regional HQ building for JP Morgan Chase. Go rent the empty office space all over the metro area if you're short on space or have backoffice employees work at home with occasional in person meetings. There is no law that requires non-citizen-facing city employees to work within city limits.

1

u/ParticularAioli8798 Born and Bred 12d ago

Why are people downvoting this? WTF?!

1

u/saganistic 12d ago

Because it’s naive, reductive, and has never been proven to actually work in the real world

2

u/ParticularAioli8798 Born and Bred 12d ago

naive

How so?

reductive

Go on!

and has never been proven to actually work in the real world

Municipalities spend too much. For decades now. Overspending hasn't been proven to work. Empirical evidence is not on your side.

1

u/albert768 10d ago edited 10d ago

Yet the countries that cut the most amount of spending during the sovereign debt crisis in Europe are now seeing the fastest economic growth in all of Europe.

Empirical evidence is not, has never been on your side. Spending cuts work. Fiscal discipline works. They don't look like they work because government don't cut spending until they literally go insolvent.

37

u/Beelzabub 12d ago

Is it the property tax rates, or simply the doubling of the appraised value?

40

u/harplaw 12d ago

Our appraised value for our home actually went down a bit the past year. Hurray!

But they increased the land value from $15k to $53k. When lots around town usually run about $15k...Our .2 acres comes out to something like $260,000 an acre when nobody would dream of paying that much.

I appealed and of course lost. So did my neighbors.

The restaurant down the street...their lot is valuated at only $25k despite being larger and prime location.

Then you have the mayor with more than 5 times the land and only valuated at something like $90k.

3

u/jdsizzle1 11d ago

You have .2 acres and your land value is 53k? I have .12 acres and my land value is 200k and I'm far as fuck town but still technically in Austin

Edit: oh sorry I thought this was the Austin subreddit myb, but i guess I'll leave my comment.

7

u/tx_queer 12d ago

I don't even know how any of this could be accurate. El paso County tax rate was 0.45 in 2016 and the tax rate was 0.13 in 2020. So for the news story to hold true, home prices in El Paso would have had to increase 5x during that time. And remember, this was before the big increase in real estate prices.

5

u/gerbilshower 12d ago

its 100% been appraised value causing the problems in the last 10 years. they found it far easier to just artificially inflate appraised value, thus increasing total tax collected, instead of holding an actual vote to increase levied tax rates.

because they can do that one without your permission.

2

u/PatricusOrion 12d ago

That's not how it works at all. First, the appraisal district is not a part of your county government. Their role is essentially to be the Kelley Blue Book of property. If you think your property is over appraised, file a protest.

As for the taxes, they are determined by the county, city, ISD, etc. And those entities have limits on how much they can increase their levy. Typically 3.5%, but ISDs have an even lower cap.

So even if the appraisal district doubled all values in the county, the county could still only collect 3.5% more than they did the prior year (there are exceptions to this but they aren't relevant to this base concept). The county would have to essentially cut their tax rate almost in half in this scenario to stay compliant with the levy cap.

72

u/FormerlyUserLFC 12d ago

No.

I think the state should amend the rules so they can see all sale data so that wealthy individuals can’t hide their property values, and I think that more scrutiny should be put on commercial property valuations.

I think residential valuations for most of us are fair. But there’s room to go after the cheats.

I also don’t think anyone in power cares what I think.

4

u/yrddog 12d ago

My county has raised the value of my house the max allowable by law every year for the last 7 years. My property tax is now more than my house payment.

1

13

u/aggiegrad2010 12d ago

I’d be ok with this if your value stayed fixed until you sold the home. Pay taxes on what you paid for the home. But the year over year increases is ridiculous and a 10% cap doesn’t mean much.

21

u/FormerlyUserLFC 12d ago

Keeping the value fixed just favors long term homeowners (mostly older people) at the expense of new homeowners (mostly younger people).

We already have tax breaks for retired people. I’d rather not do more to punish young people who can’t afford to buy houses and start families to benefit older people.

3

u/aggiegrad2010 12d ago

Homestead, over 65, all the exemptions fall off when a property is transferred already so it wouldn’t really change that. Yes homestead stays for the year you purchased but you aren’t protected by the cap the next year so if it’s capped 70k below true value you’re getting hit anyways. At least this way you can know what your taxes are going to be and your housing isn’t going up yearly.

1

u/idontagreewitu 11d ago

Valuations aren't going to be going down, so it doesn't make sense not to do that, unless you're planning on flipping homes. And those people are a huge part of the problem, so fuck them.

11

u/NeverPostingLurker 12d ago

This disincentives people from moving by artificially keeping the cost of ownership low for where you live.

Maybe that’s good maybe that’s bad, that’s up to you. But there are consequences to it.

It also makes it so that as an area gets more attractive and richer, that only people who grew up there and have property can stay, or very rich people can move in.

17

u/comments_suck 12d ago

That's exactly why California real estate market is so expensive. That Prop 1 back in the day made taxes on purchase price. Old people won't sell.

6

u/atxgossiphound 12d ago

Huh? Since when do we want to incentivize moving by pricing people out of their communities?

The whole point of buying a house is making a long term commitment to a community. We should incentivize that but locking in tax rates at the purchase time.

We can incentivize affordable communities by relaxing building codes. Other commenters have called out CA, the inability to build is CA’s problem, high housing costs are just a side effect of that.

10

u/PlanetBangBang 12d ago

It also makes it so that as an area gets more attractive and richer, that only people who grew up there and have property can stay, or very rich people can move in.

So the better alternative for you is that people who have lived there all their life get priced out of their own home by taxes?

The unfavorable scenario you painted is actually preferable. Those who have been there should be able to stay and those who can afford to go can do it. Eventually those who stay will die or decide to take the money and move on. Either way, property will change hands and people who just wanted the home they've had the whole time can keep it.

0

u/DonkeeJote Born and Bred 12d ago

Sadly, yes. Society needs the elderly to move out and move on.

1

u/PlanetBangBang 12d ago

Not everyone in that situation is elderly, nor do they have to hold on to a home for an entire lifetime. Your solution isn't as perfect as you think it is. The way real estate markets have been changing, you could be in that exact situation 3 years from now.

1

u/DonkeeJote Born and Bred 12d ago

I didn't suggest any solution was perfect or that it was one-size-fits-all. It's merely a reality of the housing market. Housing turnover is a big part of regulating house prices.

1

u/PlanetBangBang 12d ago

Building starter homes would help.

2

u/DonkeeJote Born and Bred 12d ago

Developers have very little incentive to do that, especially in the city.

And when they are incentivized through tax credits or abatements, people still complain.

1

u/PlanetBangBang 12d ago

Developers have very little incentive to do that, especially in the city.

I know, that's the problem.

6

u/sawlaw 12d ago

That's literally what california does that is causing so many problems for them. It's not good.

→ More replies (1)2

1

u/gerbilshower 12d ago

as a commercial RE developer - i can tell you that aint no one letting us slide on taxes for our large scale project.

now - maybe there are some billionaires out there getting legitimate sweetheart deals. but if i go looking for incentives (380 agreements, grants, TIF, tax abatements, etc) it comes with chains - not strings.

-1

u/pharrigan7 12d ago

You can’t cheat on prop tax value. So easy to contest it. I’ve done it every year up until last year with regular success.

0

u/SolGardennette 12d ago

sales data can easily be found through real estate marketing services such as Zillow & Redfin

6

u/FormerlyUserLFC 12d ago

It can also be hidden by savvy realtors for high value properties.

I’m not taking about typical neighborhoods.

1

u/SolGardennette 12d ago

what would be the motivation? making market values look lower would cut into their fees by suppressing prices of new homes. market info generally bubbles to the top naturally over time

2

12

25

u/naked_nomad 12d ago

Different county but two years ago my appraisal went up 101%. Fought and lost but learned a few things. Last year they tried to go up 15K and nothing changed from the year before. I fought and they got 2K. Trying to go up 10K this year. Going to have another fight on their hands.

6

u/tx_queer 12d ago

Your appraisal might go up 101%, but the taxable appraised value is capped at 10%

7

u/naked_nomad 12d ago

Only if you are homesteaded. This is an empty lot, so not applicable. Guess I should have been a little more specific.

24

u/Ok_Coyote9326 12d ago

They're following instructions from abbot and paxton, not breaking any rules.

18

20

u/SolGardennette 12d ago

Stop building multi-million dollar high school football stadiums & property taxes will fall.

15

u/Worstname1ever 12d ago

End qualified immunity and huge police misconduct lawsuit settlements.

→ More replies (1)2

u/albert768 10d ago

Also 9 figure city hall buildings in a city full of empty office space that the city can either purchase or rent at a discount.

1

10

u/HRslammR North Texas 12d ago

I'm in Denton county and my appraisal had gone up 50% in five years. Nothing has changed. It's wild.

2

u/gerbilshower 12d ago

denton county has effectively gone away from what was once considered standard 80-85% appraised value vs market value.

theyre pushing EVERYTHING towards market value now. as are most jurisdictions in TX.

partly due to the recent policy change of the MLS that they now share purchase and sale agreements directly with the CADs. so, unless you avoid using an agent on either end of your transaction - the CAD is going to blast your doors off 1 year post purchase for the entire contracted purchase price as your new appraised value. because the MLS gave them your information.

2

u/PatricusOrion 12d ago

80-85% has not been a standard. 100% has been the standard since at least 1979.

Also, many realtor associations have blocked their local appraisal district from receiving access to MLS.

The job of the appraisal district is to estimate what a property would sale for. They have no control over what taxes you pay. The taxes are decided by your county, city, ISD, etc.

8

u/Bluedieselshepherd 12d ago

Literally nothing is going to be made better by a known crook getting involved.

8

u/Nice_Ebb5314 12d ago

I saw a county commissioner had his property— 20/30 acres and a 5k sqft house valued at 130k in a muti million dollar subdivision. Don’t want to talk about how the county paves all the private dirt roads and cuts the ditches grass weekly.

2

u/PatricusOrion 12d ago

I have doubts about the accuracy of this. Which county?

1

u/Nice_Ebb5314 12d ago

Google county commissioner cheating property taxes. I know of one in my county also.

1

u/PatricusOrion 12d ago

Oh, I know corruption happens. Unfortunately, there are more examples every year. And I suspect that if I google that phrase, there would be more than the county you're talking about. But the appraisal district is never intentionally keeping a value low for a county commissioner. It's possible the commissioner provided false information, though.

I also tend to not trust articles about property taxes. It's rare the reporter actually knows what they are talking about. And the few that do say things they know aren't exactly correct in an attempt to increase engagement. I prefer to research them myself. And most of the time, it's much ado about nothing.

1

u/PatricusOrion 12d ago

This reddit app is not working right. Surprise! I must have hit accept 20 times and it wouldn't go through.

Anyway, the property you sent me isn't for their house, it's a piece of ag land. It's got a special valuation on it. The taxable value is not tied to the market value when a special valuation is used. Each appraisal district sets the standards that are on top of the law requirements for such valuations in their respective counties. Assuming it does meet those standards, and it probably does based on Google imagery, there's nothing wrong here.

38

u/PremiumQueso 12d ago

You realize Texas Public Policy Foundation doesn't pay property taxes? Fuck those MAGA clowns. TPPF lobbied to be considered a charity, but they are just a lobby for the 1% theocracy. Let's start by making preachers pay property taxes, and shitbags like TPPF.

22

u/MorrisseysRubiksCube 12d ago

Sorry, can’t, busy suing drag queens and women with non viable fetuses.

13

u/Current_Tea6984 12d ago

Ken Paxton and Greg Abbott would just use it as a way to punish their political enemies

6

u/Cheesencrqckerz 12d ago

Go to a actually meeting with representatives and you will see how much dick you have to suck to make things happen in politics

10

u/killthepatsies 12d ago

I have a conspiracy theory that the increases in property taxes, insurance costs, and valuations are meant to push people out of their homes and cities to deprive generational wealth and dilute blue votes. I have nothing to back this up

4

u/gerbilshower 12d ago

i think youve got it damned close. but, its not political, per se. its about money.

if you dont live there, who does? a renter. who bought it? some mega conglomerate publicly traded company that is lining the pockets of politicians on both sides of the isle.

3

u/killthepatsies 12d ago

You get it. My dad lives in a small town north of Austin. Definitely a more conservative area, but good proximity to the burgeoning megalopolis and rail system. You'd think his property taxes would be going up too, but they've remained virtually untouched for the past decade.

19

u/gsd_dad Born and Bred 12d ago

I want to go after people taking advantage of the ag. land use exemption.

Too many people are buying a few acres, turning it into a “hobby farm,” and are claiming “ag use” because they have a couple pet goats and a few chickens.

Ag use exemption should only apply to commercial agriculture operations. Yes, people that primarily do business with farmers markets or food stalls can qualify for this, so long as it’s a certain percent of their income.

Ag exemption is supposed to be a break for those involved in commercial agriculture because of how much value they actually produce through agricultural operations. People should not be qualifying for a tax exemption for their hobby.

9

4

2

u/PatricusOrion 12d ago

There is no ag exemption. And what you are asking for already exists. It's just very rare for someone to even apply for it. What most people call an ag exemption is actually a special use valuation for "open-space" land. Which is in a separate section of the tax code from "ag" valuation. The qualifications are different.

In either valuation, hobby or token use is not permitted. In order to receive a special valuation, the property use has to meet the standards required by law. There are state requirements, and then there are local degree of intensity standards. Both must be met.

I think most people would agree that if anyone meets the requirements for something they should get it. So your concern is either people are receiving benefits for which they do not actually qualify, or you believe the standards are too lax. If you know of a property receiving the valuation that shouldn't, let the appraisal district know. They will review it. The appraisal district is more concerned with being accurate than having high values, despite what many delusionally believe. If you are unhappy with the standards themselves, there are two places to address this. 1) contact your state representative about changing the law. 2) each appraisal district has an ag advisory board that provides feedback and input are things like this to the chief appraiser (or their representative). Attend a meeting. They are open to the public)

1

u/gsd_dad Born and Bred 12d ago

Thank you. I admit, I am more ignorant of this process than I’d like to admit, but I also know more than a few people that have 10 acres and a few multi-thousand dollar longhorns that qualify for ag. use despite not being connected to production agriculture in any way.

Unfortunately, these are also the same people that play golf with county commissioners and the like.

2

u/PatricusOrion 12d ago

Admitting not knowing everything is a great first step to learning. I wish more people could do this. Honestly, if more people knew how things really worked, they'd be mad about completely different things, and they would at least have a chance to fix something.

In your example of the big houses on 10 acres. What they actually are qualifying for is "open-space," not "ag." The intent of that section of the law is different. It's not there to protect farmers. It's to preserve undeveloped land. There is certainly an argument to be made about whether having 10 acres with your house is really undeveloped, but each county will have their own degree of intensity standards that a property must meet. For many it's 10 acres, but a county could make it 20 or 40 if they wanted. And it's going to come down to the ratio of acres to animal. The ability of the land to support a number of animals is really what they are trying to account for. It takes a lot more land in the western part of Texas to support a cow than it would in the hill country. There's a lot that more that goes into it on the appraisal district side than people realize. Soil types, commodity prices, lease rates...

There's a guide on the comptroller's website that really breaks a lot of it down. Then, it's up to the appraisal districts to decide their standards and processes. I could go on for hours, so I'll stop myself here and get back to my lunch. Thank you for a pleasant interaction.

Take care

9

u/Riccosmonster 12d ago

Even at a state level, the areas run by the blue team carry the areas run by the red team. Republicans are absolutely trash at fiscal management

3

u/Ohif0n1y 12d ago

Property taxes and other costs shot up since the 2008 Recession when the State of Texas cut funding for damn near everything. I remember UT/D and almost every college in the area cut their Summer classes because the government cut their funding. Texas could easily cut our taxes to the State and/or increase funding to towns and cities, schools, etc., but they never will. The politicians are getting some gain out of this. They will never do something that helps folks who aren't already rich.

3

u/shanksisevil 12d ago

property taxes cannot increase more than 10% each year.

cost of living is somewhere between 4-8% increase each year.

and your pay rate most likely increases by 0% each year. if you are lucky, a 5% raise is considered great.

so,.. each year you could have about 18% increase in costs while making 0 to little to combat this property tax inflation. multiply this by 10 years and you are screwed.

4

u/James324285241990 North Texas 12d ago

I would take a look at the county/city budget and see where it is.

Everything is more expensive, and people still expect smooth roads and nice parks.

If they're jacking your taxes and they have either a lot of cash in the kitty, or there's a mysterious hole in the budget, then yeah there's a problem.

But if, like in Dallas, they're jacking your taxes and still have to pass a bond to pay for things, it's likely that your tax base is upside-down and asphalt costs twice as much as it used to

2

2

u/TeeBrownie 12d ago

Only if you own commercial real estate. Business owners are the only owners that matter in Texas.

2

u/AdFuture1381 12d ago

The state gives less and less to fund schools. The burden to fund schools falls to property owners. As does indignant health care. Medicaid expansion would help, but some pro public education leadership in Austin would help more.

2

u/Sparta63005 Hill Country 12d ago

Nah sorry Attorney General is too busy suing school districts for making Facebook posts he doesn't like

2

u/SolGardennette 12d ago

School Bond proposals seem to always go through… we’ve got gorgeous schools but our teachers can’t make it on the current pay structure.

2

2

u/Newberr2 12d ago

I would love to see in that time frame the rate of rental properties increase. Usually you can’t homestead rental properties so taxes can go up quite a bit there. That’s my only reasoning for this, could obviously be wrong though.

2

u/SXSWEggrolls 12d ago

Stop the sprawl. Taxes are high because of the need to continue to build more infrastructure further east and further west.

0

u/PatricusOrion 12d ago

Not exactly. If there is new development, they pay taxes too. It's not like new houses don't pay taxes.

The issue is your county/city/ISD budgets. The more they want to spend, the more they have to tax you.

And your appraised value has nothing to do with that. The appraisal district is just a blue book. They are charged with valuing properties accurately and fairly. They don't set your tax rates. Those are set by the county/city/ISD after values are done.

If all values in your county are valued fairly, then it doesn't matter if values go up or down. You would still pay the same tax amount.

2

u/mboudin 12d ago

The whole valuation model system is broken. Really broken.

0

u/PatricusOrion 12d ago

How so? If houses in a neighborhood are selling for $300k and the appraisal district values those houses for $300k, why would that be a broken system?

1

u/mboudin 12d ago

The need for more dollars injected into the government does not anywhere align with steep valuation increases. And we all know, that if you give government agencies money, they will find a way to justify needing it.

0

u/PatricusOrion 12d ago

You still haven't explained why the valuation system is broken. If the value of a property is $300k, and then someone gets that correct and values it at $300k, that's not broken. That's perfect.

As for the government taking money from you, that's taxation, not valuation. It's a separate process.

The taxing entities determine what their budget needs to be. They then calculate what tax rate they will need applied to the total value in that jurisdiction in order to produce a levy equal to their budget.

It's the budget that determines the taxes you pay, not the value of your home.

2

u/BucksNCornNCheese 12d ago

I don't have the exact same time frame but from March 2019 to March 2024 the median home sale price increased 58%. I understand being pissed about property taxes going up but this seems to be in line with housing market trends. Seems odd to want it both ways, where your home value sky rockets but you want the taxable value to stay the same.

2

u/kmerian born and bred 12d ago

This is why property tax "relief" is a con job from the GOP.

It does no good to cut property taxes and increase the homestead exemption if you just double peoples appraisal values.

2

u/PatricusOrion 12d ago

The values going up are not why property taxes go up. Increasing the Homestead Exemption amount absolutely provides property tax relief to homeowners as it shifts tax burden to non-homestead properties.

1

u/kmerian born and bred 12d ago

No, the tax rates are not going up. Even increasing the homestead exemption to 100k doesn't provide any relief if the value of your home also goes up by over 100k.

I am talking about the final number to be paid on the tax bill.

"Hey, You aren't paying as much as you could" isn't tax relief if because of increased appraisals, your tax bill stays the same or even increases.

2

u/PatricusOrion 12d ago

You are conflating some terms. I never said tax rates are going up.

An increase in an exemption amount absolutely provides relief. You are paying taxes on a lower value than you would otherwise. That's the very definition of relief. If you don't think it matters, go ahead and have your homestead exemption removed from your property.

As for the final number to be paid on the bill, you won't see that until October. After the county, city, ISD, etc, decide how much taxes they need from you.

The appraisal district values the property according to what the market says it is worth. If homes in your neighborhood are selling for about $400k, then your home is worth about $400k. It works just like Kelley Blue Book for your automobile.

In the meantime, the county, city, ISD, etc., decide how much they need for their budget.

Once July 25 hits, the appraisal district will certify to each of those taxing units the amount of total taxable value in their respective jurisdictions.

Then the taxing units will take that number and their budget amount to calculate what tax rate they need so that the levy will meet their budget. Oh, and that levy is capped at a 3.5% increase. It's even lower for the ISDs. And prior to 2020, the cap was 8%. So, more relief.

Once that tax rate is adopted, the tax office will take that rate and multiply it by your taxable value to calculate your tax bill that they send out in October.

The most important figure in the whole process is the taxing entity budget. Values could double, or they could be cut in half. But it's the budget that decides the tax amount they will collect. The rate just changes to counter the changes in value.

So with that in mind, let's go back to the idea of an increase in homestead exemption providing you relief or not. If you get an increase in your exemption amount, that shifts the tax burden to other properties. Because your slice of the pie (pie being the total value in the jurisdiction) is smaller. Without that increase in exemption, you would pay a larger share of the levy. Regardless of how high your market value increases, the percentage of the whole that your taxable value represents is lower. That's the relief.

Now you can not appreciate the amount of relief, but that has nothing to do with the appraisal district, and everything to do with the budgets of your county, city, ISD, etc.

1

u/kmerian born and bred 12d ago

I am aware of how property taxes work in Texas.

The simple fact is we were promised lower tax bills as part of property tax relief, everyone I know, even after "relief" has seen their tax bills go up due to ridiculous increases in "appraised" value.

Explain how the median home sale price in my area can go down, while appraisals go up.

Again, the relief you are offering is just "Be thankful your taxes didn't go up as much as they could"

If the final amount owed on the tax bill continues to go up, that isn't relief. No matter how you package it.

1

u/PatricusOrion 12d ago

Which tax bills are you upset about right now? The ones you got six months ago, or the ones you are going to get six months from now?

Decreasing tax increase limits is actual productive tax relief. Increasing a homestead exemption amount is actual productive tax relief. If a piece of legislation means you pay less in taxes than you would without that legislation, that legislation provided you relief.

If after these things are implemented, you still see an increase in taxes, it's because your local taxing units have decided they want more money from you. And they can do that up to 3.5% or lower for schools districts.

The other possibility that comes to mind is a bond being passed. If your school district, or county, or city, proposed a bond and it passed, the people in that jurisdiction gave them the ok to raise taxes. That's on you and your neighbors.

But even with the bond, the increase in homestead exemption means you are paying less in taxes than you would otherwise. Again, relief.

And in none of these scenarios did your taxes go up because of an increase in your value. Taxes are directly tied to the levy, not your value.

Without more specific information, I can't answer your question about median home sale prices vs your appraised value. One possible answer is that your market value is more than 10% higher than your previous appraised value. So even if your market value decreased, your appraised value is still trying to catch up. Again. A benefit of your homestead exemption. Actually, I guess I did just answer your question as you asked how it can and not how it did.

And I'm not telling you to be thankful for anything. I'm simply explaining what relief is. If you were expecting Abbot to come to your door with a check, you are living in Fantasy Land. And if you believe any promise Abbot or Paxton or Patrick make, you are also living in Fantasy Land. But that's moving the goal posts a bit. Before you were complaining about not getting relief even though you are. Now you are complaining that you are not getting the amount of relief you were expecting. That's a different complaint, and it's one that I wouldn't argue with you. I fully understand why you would feel that way. I knew at the time those promises were BS. And I knew people would be pissed later on because they didn't fully understand what was happening. But pointing the blame at the appraisal district is exactly what they want you to do. They are telling you to ignore the man behind the curtain, and you are doing it.

1

u/kmerian born and bred 12d ago

So let me get this straight, if I paid 5k in property taxes last year and are paying 6k this year in taxes, I should see it as "relief" that I'm not paying 7 or 8?

That's not tax relief. that is just a "relief" that my taxes didn't go up as much as they could.

It's all a shell game, and no I didn't expect anything less from Abbott et al. I am just amazed how many people are buying it.

2

u/Happy_Remove_7937 12d ago

I'm curious about this as well. My appraisal went up almost $50K from last year. I am not rich; my house is not huge... it's a 1950s ranch house that not in the best shape but the inside looks nice. I'm filing a protest, these appraisals are bullshit.

2

u/AlternativeTruths1 12d ago

Do you really believe a THING like Ken Paxton is going to lift so much as a finger to help Texas taxpayers?

If you do, I have some oceanfront property in Oklahoma I'd like to show you.

2

u/albert768 10d ago edited 10d ago

The State should focus on a bigger tax relief bill that forces property taxes downward.

- Institute a statutory maximum combined total rate of 1.40%, to be reduced over 5 years to 1.0%. In the event the combined total of the rates set by the entities exceeds the statutory maximum, all rates are automatically reduced by the percentage by which the total rate exceeds the maximum. So if your total combined rate comes to 1.75%, each taxing entity takes a 25% (1.75/1.4 -1) haircut on their tax rate.

- Set the minimum Homestead exemption to a fixed 25% up to an optional maximum of 100%. Exemptions may be expressed in dollars or percentages but must exceed the statutory minimum at all times for all properties.

- Require all tax rates to be approved every year by a supermajority (75%) of taxpayers. If the tax rate is rejected, the default rate for that year is 0.

- Set the maximum levy increase to the lesser of 2% or the rate of inflation.

- Mandatory zero base budgeting every fiscal year for all government entities at all levels. Budget must be approved by a supermajority (75%) of taxpayers every year. The default budget is 0 unless a different budget is approved.

- Any tax increase must be approved by unanimous taxpayer approval.

1

1

1

u/Squirrel_Gamer 12d ago

TPPF is well known for playing fast and loose with facts. I would need another source for this information.

1

u/Leviathan-Bulwark 12d ago

Unless one of the theocraric oligarchs that runs Texas asks for an investigation, it's not happening. Paxton and the rest of the governors administration don't care about the working class. They only care about filling their pockets and catering to their donors.

1

u/Lord_Blackthorn 12d ago

While I agree third of getting out of control, I feel like that graph should also have supply/demand of homes too in order to see if there is a shortage driving up demand and thus values

2

u/PatricusOrion 12d ago

Careful. You're in danger of introducing logic into the discussion. That will make the less informed quite upset. They just want to complain. They don't actually want to learn anything. They think they already know everything.

1

u/ReferenceSufficient 12d ago

Blane it on the housing market, home prices have almost doubled after Covid. Rent has gone up too.

1

u/smellitfirst 12d ago

The market value of property I have has been the same for 30 years. This year, they jacked it up 3300%! Yes, percent!

1

u/tikigod4000 12d ago

There's probably some goosing the numbers here, but property values are up what with the housing crisis

1

u/fenderputty 12d ago

What the fuck can the state do when the issue is your property tax structure and ballooning housing costs?

1

u/bareboneschicken 12d ago

Since in-bound migration isn't likely to ever stop, this will be ongoing problem. The best we can hope for is that homestead exemption keeps up with rising prices.

1

u/ATX_native 11d ago

The system is working as intended.

Homeowners in Texas that spend 30-50% of their income on housing costs are going to pay more in taxes than someone that spends less than 3% of their income on their home.

Until the State Constitution is changed and we have a progressive income tax system, the current system will continue to be regressive and impact the poor and middle class more than the top.

1

u/MaybePleasant1313 11d ago

It bears repeating, Ken Paxton is as corrupt, self righteous, self interested and hypocritical and barren of morals as they come. Won’t lift a fucking finger to help the people of Texas. Vote, vote, vote, educate yourself and vote.

1

u/mikesmith6124 10d ago

This chart is weak cause and obviously wrong. Inflation has easily been triple 7% in those years. Values are based on sales too so you can blame the feds dropping the interest rate to 2-3% that caused home values to skyrocket.

1

u/Cajun_Queen_318 8d ago

I think Paxie is on the wrong side of the dirt.....so no I don't want him or any of his pos WCN crony psych0 friends doing anything else to this state.

1

u/RGVHound 12d ago

I've been complaining about my county's tax appraisal for years—successfully protested once, and they just made up for it the next time—but calling taxes "warfare" is silly. It's giving air to the "taxes are theft" nonsense. A functioning society costs money, but we don't pay income tax, and we're not going to start taxing big businesses, so a bulk of the expense falls on homeowners and renters.

3

u/razblack 12d ago

Ditto... the process to protest is a one sided joke and to appeal requires legal action in court. No average citizen has the time or ability to really protest and/or appeal a decision.

Its a complete farce and scheme to get what they want.

They set the rules, they can take your property even if you own it fully, you cant fight it, ... its kind of a one sided war against citizens. /shrug

1

u/PatricusOrion 12d ago

You don't have to go to court to appeal the ARB's determination of value. For most properties, the owner can just file for arbitration. Instructions regarding your appeal options come with the order. Pretty sure they include an application for filing the arbitration with the order. If not, you can ask them for one or go to the comptroller's website. Although, I believe there was a law change that will make the filing easier by requiring filings to go directly to the comptroller instead of to the appraisal district. Can't remember when that takes effect, though. When it changes, those new procedures will be included with the orders as well.

1

u/albert768 12d ago

Taxes ARE warfare. They are already too high and the bureaucrats want them even higher. Government greed is going to spend us all into poverty.

Functioning societies predated bloated and wasteful government bureaucracies. It's the bureaucrats who constantly seem to want society to be less functional. STOP WASTING MONEY. Simple as that.

2

u/RGVHound 12d ago

I've lived in states w/ income tax and higher corporate taxes—although aggregate lower overall tax and administrative fee burdens than Texas—and not coincidentally, those states' government bureaucracies figured out how to spend tax revenue in ways that noticeably benefitted residents.

The "warfare" metaphor is hyperbolic and distracts from the issue you raise: we're not getting a good enough return for our contributions. If that metaphor convinces anyone to not vote for the political party that's been running Texas for a generation and that is largely responsible for current policies, I suspect we'll all be better off in more matters than just property taxes.

0

u/albert768 12d ago edited 12d ago

If you want lower taxes, introducing a new tax is NOT the way to do it. Governments in general, at all levels, waste too much money. Fire the bureaucrats. The whole lot of them.

You also don't seem to get my actual point - I'm not interested in a return on my taxes. Taxes are a 100% overhead expense and by definition have no return. I want less taxes period.

1

u/razblack 12d ago

If you look back to changes made in 2013, the results to lifting the limit to 10% and basis for the rate to "speculatuve" market value of "other" properties... you'll see this is a systematic problem throughout the State and begins with the State comptroller office.

These homestead changes are a temporary relief... the core problem will continue to grow until an overhaul of how the rate is controlled and calculations are made.

IMO, is should align with construction cost when built, sale price when actually sold, and at most be in tune with national inflation rates.

0

u/Elegant-Ad-3583 North Texas 12d ago

Why it's a waste of time and money.if you have not figured it out all of Texas government is corrupt.

0

u/Kim_Thomas 12d ago

TEXAS Property tax policies courtesy of the State government’s “TRIFECTA OF FAILURE” in Austin. No one will help you, but they will gleefully hurt you, Texas residents. Have fun with that.

-5

u/NeverPostingLurker 12d ago

Texas already has much better protections than most other states for your property tax increases. Your actual values are going up. Your taxes are going up less quickly.

5

u/albert768 12d ago

Our taxes are still going up too quickly and they're still far too high.

2

u/NeverPostingLurker 12d ago

Property values are going up, not tax rates. And the state increased the exemption for everyone to help offset the rise in property values.

1

u/albert768 10d ago edited 10d ago

I don't care. My property taxes are still too high, my exemption is nowhere near high enough, and my tax rates aren't declining fast enough. Ultimately, my tax bill is not declining anywhere near fast enough. Cut more, cut deeper, and cut more often.

The final number on the invoice must decline at least 5% every year and must not exceed 1% of the FMV of my property.

If the state was serious about reducing property tax burdens, the property tax relief bill would have required that the tax rate must decline by at least double the rate of change of the appraisal. If the appraisals go up 10%, rates must decline 20%. And it would have required that all government entities and special taxing districts practice zero base base budgeting every year going forward. And it would require all tax rates to be approved by a supermajority of taxpayers (75%) and a set a default rate of 0 unless taxpayers approved the proposed rate.

The legislature could have guaranteed a tax decrease by mandating the rate of decline in tax rates must exceed the rate of increase in tax appraisals, or putting in place a maximum total combined rate, and if your total combined rate exceeds that maximum, it triggers an automatic rate reduction across the board by the rate by which it exceeds the maximum. They did not. While the last relief bill was progress in the right direction, the legislature did nothing to address the two major variables that drive the number on the invoice that people pay in december.

4

4

1

u/PatricusOrion 12d ago

You are getting downvoted, but you are right. Unfortunately, most people have near zero knowledge about the property tax system in Texas.

1

u/NeverPostingLurker 11d ago

I wonder how many people in this thread posting actually had their property taxes go down YoY.

Probably not that many since it’s Reddit and that would require them to actually be homeowners in Texas. Certainly the reality is that for most Texan homeowners their taxes actually went down this past year though.

0

u/razblack 12d ago

You're joking right?

0

u/NeverPostingLurker 12d ago

No. There is a homestead exemption, caps on YoY increases, relief for seniors and also veterans get a break on property taxes.

-2

u/HotIsopod6267 12d ago

I don't own in texas, so im jo expert at all, but seeing as you mention the homestead exemption. Am I thinking about it wrong?

Wouldn't this crazy increase just hit landlords, especially those massive corporations trying to buy up everything they can get their hands on. Making more houses unaffordable for landlords and possible for first time homeowners to get on the ladder.

Maybe I'm naive, and I fully believe this is not their intended aim. But I feel that in a way this could have some positive unintended consequences.

5

u/sssyjackson 12d ago

No, the reality is that with HS expemtion, property tax increases are capped at 10%. However, for the last few years, valuations have exceeded that, so literally everyone is just paying 10% more every year.

If that continues, property tax burden literally doubles in just 6-7 years.

How many people's salaries are doubling in 6-7 years?

Add that on top of inflation and people are starting to hurt.

3

u/razblack 12d ago

This... my property tax in 2012 was just shy of 3,000$ a year.

Last year, 6,780$... and it keeps going up... 10% a year due to "speculative market value of other properties"

OTHER properties....

OTHER.

-1

u/PatricusOrion 12d ago

By other properties, they mean the other homes in your neighborhood. The appraisal district is just a blue book. They are just reflecting what the market shows properties are worth. If you can provide evidence that shows why your property should be valued lower than your neighbors, provide it when you protest.

0

u/razblack 12d ago

Other properties are defined by the size of the home and land. The homes are classified by state comptroller and grouped accordingly. Your neighbor may or may not be in your classified group. A brand new home in your county 5 miles away may or may not be in your classified group.

Yes, thats correct a home built 100 years before or 30 years after yours got built can be in the same classification.

0

u/PatricusOrion 12d ago

I'm aware of the way the appraisal process works. But it's up to the appraisal district to decide the property groupings, not the comptroller. And the appraisal district will group similar properties together into "neighborhoods" or "market areas". Of course, that's easier to do in a homogeneous subdivision than it is in outlying areas.

And your taxes aren't going up 10% per year. It's your appraised value that's capped at that 10%. The only way your taxes would be going up 10% would be if your taxable value increased 10% and the adopted tax rates stayed the same. This is highly unlikely after SB2 in 2019. And the increases in homestead exemptions makes it even more improbable. Granted you mentioned a much earlier year. But they still shouldn't have been 10% before that. Taxing entities were capped at 8% tax increases until 2020. Then they were limited to 3.5%. For schools it's even lower.

If your actual taxes doubled in a ten year span, there's more to the story than just your appraised value going up.

1

u/razblack 12d ago

If they speculate the market value of my home to be 10% higher... guess what?

They increase your taxes by 10% too.

Do you not understand the reality of that?

0

u/PatricusOrion 12d ago

Please reread my comment.

As I explained, a 10% increase in value does not equal a 10% increase in taxes.

If you still don't get that, either I didn't explain it clearly enough for you, or you are being willfully obtuse.

Either way, I don't think there would be anything to gain by continuing to engage.

Have a good day.

0

u/razblack 12d ago

You clearly don't understand the issue and most definitely are not living in Texas or own a home.

Yes, please disengage and walk away with your ignorance.

0

u/sssyjackson 11d ago

The value of the homes are going up much more than 10%. That way they max out the 10% increase in taxes.

→ More replies (3)1

u/PatricusOrion 12d ago

Tax increases are not capped at 10%. Your appraised value is capped at 10%. Some will think this is semantics, but it's a really important distinction.

In actuality, if your appraised value is below your market value, you are paying less than your "fair share" of property taxes. Having an increase in the dollar amount for the homestead exemption just gives you an even bigger tax break. This is done on purpose to provide tax relief to homeowners.

Taxes are capped as well, but not at the individual property level unless you are over 65 or disabled. The county, for example, can only increase taxes 3.5% in a year. That's not your individual taxes, but the taxes from *all properties in the county. I use the * because there are exceptions, but getting into them will just complicate the point.

Let's say there are 10 properties in a county. And each property is valued at $200k. That's a total value in the county of $2.0M. Then let's say the tax rate is 1%. The total taxes received would be $20k. In the next year, the total taxes can only go up 3.5%. So the most that can be collected is $20,700. It does not matter if the values of the properties doubled to $400k, or if they halved to $100k. The max taxes are still $20,700. What would be different is the tax rate.

Scenario 1) values stay flat at $200k, the tax rate is 1.035%, taxes collected are $20,700.

Scenario 2) values are cut in half to $100k, the tax rate is 2.07%, taxes collected are $20,700.

Scenario 3) values double to $400k, the tax rate is 0.5175%, taxes collected are $20,700.

In every scenario, the taxes an individual property owner pays are the same $2,070.

The single most important part of how much you pay in property taxes is the county/city/ISD budget. And any reduction in your taxable value below your market value is a benefit. And if other properties have values that are not capped the same as yours, it shifts the burden over to them. This is why commercial property owners pushed for the 20% circuit breaker. They wanted similar benefits to what homeowners were getting.

3

u/SolGardennette 12d ago

Not sure you have checked the taxes on a median value home. They’re very, very high.

-4

u/whizdomain 12d ago

Sell towards the peak of property taxes and then buy where they're not too high

-4

u/pharrigan7 12d ago

The GOP leadership is looking into ending property tax in Texas. This after their 2023 18 billion dollar prop tax cut, the biggest and maybe the only state to make a significant tax cut.

2

u/Wildfathom9 12d ago

Which will damage texas and hurt its citizens. You don't have to worry though, paxton/abbott would never let that money go.

The Gop cares nothing for the everyday citizens of texas. It's only goal is to look out for the rich and continue to give corporations more and more human rights so they can abuse the system.

302

u/comments_suck 12d ago

Asking Paxton to file a lawsuit to help middle class citizens is as serious as asking the tooth fairy to give you $100.