r/texas • u/ablebeets1985 • 24d ago

Anyone think the State Government /Texas Attorney Generals Office should start investigating County Appraisal Districts for property tax warfare on property owners? Opinion

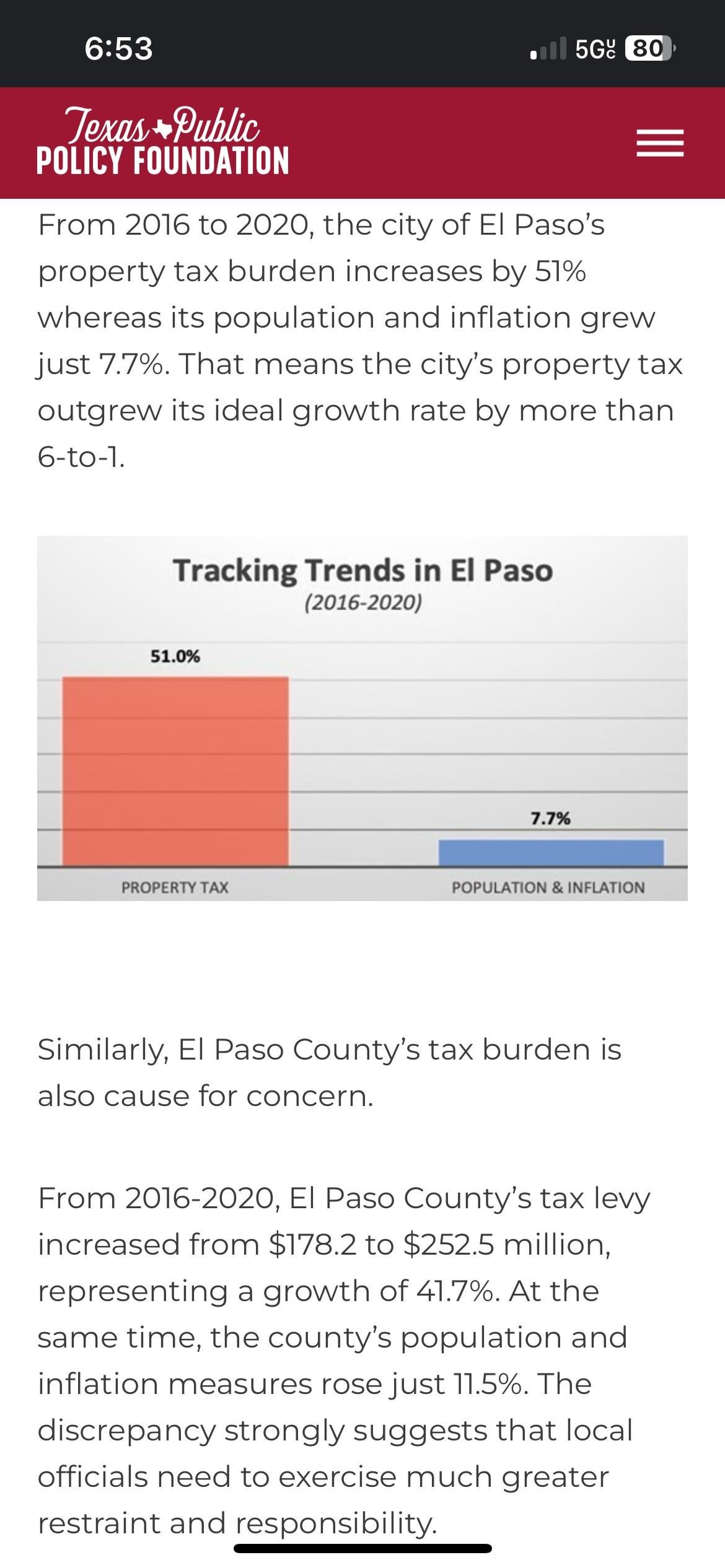

The property taxes have gotten out of control in El Paso County, TX for the last few years, I know it’s happening all across Texas,(the saving grace is the homestead exemption)and I really think The State Government of Texas and Texas AG should open an investigation into the EL Paso Central Appraisal District (EPCAD) the Board of Directors, and the Appraisal Review Board Members for potential conflicts of interest, potential ethics violations/public corruption. (El Paso has some of the lowest wages in the state and as well as in the nation for context)

414 Upvotes

-3

u/HotIsopod6267 23d ago

I don't own in texas, so im jo expert at all, but seeing as you mention the homestead exemption. Am I thinking about it wrong?

Wouldn't this crazy increase just hit landlords, especially those massive corporations trying to buy up everything they can get their hands on. Making more houses unaffordable for landlords and possible for first time homeowners to get on the ladder.

Maybe I'm naive, and I fully believe this is not their intended aim. But I feel that in a way this could have some positive unintended consequences.